Your Competitor’s Marketing Plans Revealed!

Your Competitor’s Marketing Plans Revealed!

What if…

A healthy percentage of your lenders exceeded their annual production goals…by June 30th?

What if…

A healthy percentage of your lenders produced more than twice their annual sales goals annually without working any harder then they currently are working?

We’re not surprised by these results. They are quite common for our clients. We’re talking documented results!

We’re accustom to seeing a $4M to $5M annual producer produce $8M to $10M with the same or less effort as it took to produce $5M. We’ve watched $10M to $17M annual producers produce $25M, $30M or more with the same amount of energy as it took to produce $10M.

They’ve doubled their production without working longer hours.

Here’s the honest truth, the sales activities of the majority of lenders are inefficient and moderately effective. Your lenders are simply working way too hard for what they produce.

And the problem isn’t interest rates, competition, or market conditions…it’s your lender’s outdated and antiquated marketing and sales approaches that are the problem! They’ve been marketing bank products and services in exactly the same way for the past two to three decades.

It’s that simple…and good news…it’s not that difficult, time consuming or costly to correct. The cost of the solution is pennies in comparison to the cost “under-performing” lenders have on bank profits. Yes, your “A-players” are under-performing.

Your Competitor’s Marketing Plans Revealed!

In my last blog, I promised I would show you the exact marketing plan your competitors are using to source new business. How valuable would that be? Incredibly valuable.

For over 16 years, my partner Lisa and I have been modernizing and honing the sales strategies of commercial lenders and affecting positive cultural change by helping their banks become more market driven.

As you can imagine, we’ve witnessed first-hand, how thousands of commercial lenders across the country market, sell and speak about their bank’s products and services. Before I share your competitor’s marketing plan, I want to share six of the more striking marketing similarities among commercial lenders in every State:

- They tend to be generalists – Most lenders know a little bit about a lot of different industries. The old “jack of all trades…master of none” adage applies. As a result, the “value-add” a lender brings to a prospective customer is greatly limited. The typical lender’s marketing approach is “shallow and wide” as opposed to “narrow and deep” and accordingly they’ve positioned themselves as a commodity. Now in rural and smaller markets, a narrow and deep marketing approach isn’t as feasible. In those instances, differentiation can be created by a marketing approach that is more of a blended strategy we define as “narrower and deeper.”

- They sound alike – Lenders in every state use the same jargon, acronyms and buzz-words and make the same representations to prospects and customers as their competitors. There are a ton of banks and bankers who still believe talking about their customer service makes them distinctive. Take look at your own website and see if this is true about your bank. As a result, your lenders sound like “talking brochures” when talking to prospects and customers and your bank has no discernable uniqueness. And because of bullet #1 above, most lenders do little to tailor their conversations to their audience or to develop questions that are specific to the customer’s industry. This results in further commoditization.

- They sell alike – 80% of lenders actually manage the sales process in exactly the same way as their competitors. They behave the same way too. The approach is very transaction-oriented and financial-package focused. As a result, customer expectations of banks continues to decline because most every bank offers the same, traditional suite of personal and business credit, deposit and cash management solutions. Practically every bank also touts their bankers as being “trusted advisors” and “consultants.” It’s become similar to the customer service representation made by banks…but actual lender behaviors face-to-face with prospects and customers are anything but advisory or consultative. This I promise!

- They limit their value to the customer – Most commercial lenders view themselves as experts in financing as if this makes them unique. Just the opposite is true…being an expert in financing makes you a commodity. This is the bare minimum expectation of lenders. As a result, this gives your bank minimal if any competitive advantage. Granted, on a one-off transaction where you can close quickly or structure a credit in a unique way to satisfy a borrower’s need does give your bank a competitive advantage. But overall, being an “expert in financing” is part of a list of “standard” features expected of a bank. Not many people are terribly interested in buying a car that only comes with the “standard” list of options. But that’s the trend in banking.

- Over reliance on third party referrals – The primary way most bankers get new business is through referrals from commercial real estate brokers, CPAs and a few attorneys. Customers have historically provided referrals too. Essentially, most lenders want to be “dropped into” an already underway transaction where they can leverage already established relationships of other trusted advisors. And, there’s nothing wrong with that with two exceptions, #1. Eight out of ten times, lenders are being dropped into a bidding war. Bidding wars involving multiple banks competing for the same deal provide almost no opportunity to differentiate your bank from other banks competing for the same business, #2. Because of the newness of the relationship, the lender doesn’t have much of a connection with the borrower and no loyalty has been built. The primary factor that distinguishes one bank from another in a bidding war is rates. We call bidding wars a “red ocean” sales opportunity similar to the color of the ocean when frenzied sharks rip at a dead carcass. What most bankers aren’t very good at is creating what we call “blue ocean” sales opportunities. Blue ocean sales opportunities are opportunities where a prospective new loan or deposit customer selects their new bank without much if an interest in comparison shopping other banks and where rates aren’t in the top three considerations for choosing their next bank. The bottom line is bankers rely predominantly on luck and the efforts of their “COIs” to fill their pipeline. If that isn’t a scary proposition I don’t know what is? If no referrals are received, a lender usually has a weak pipeline. It’s that simple.

- Time wasted on poor quality prospects – As a result of point #5, a very high percentage of the referrals received by bankers are of poor to low quality. This creates a whole host of ripple effects including:

- Time wasted driving to and meeting with prospects only to find out that they aren’t a match your bank’s credit and industry profile

- The awkwardness that is created when a banker has to tell his / her referral source that they can’t help the person who was referred

- Bankers who are behind on their goals and feeling pressure to produce will spend time on “long-shot” deals to pad their pipeline report and have something new to talk about at the Monday morning marketing meeting. Now they’ve not only wasted their own time but also wasted the time of their credit analyst as well.

The marketing and sales behaviors described above have existed in banking for over 30 years! So without further ado, I promised I would show you your competitor’s marketing plans so here they are!

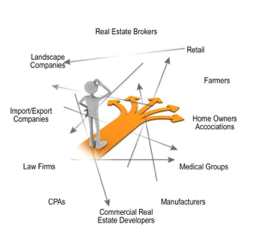

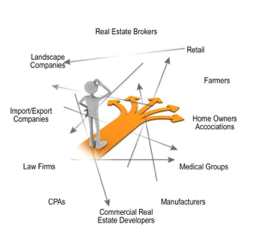

This is a visual representation of the marketing plans used by your competitor’s lenders.

Now this is not what their lender’s written marketing plans say they’ll do to develop business. Nor is it what your lender’s written marketing plans say. But, it is what they do!

But make no bones about it, the above diagram accurately depicts exactly how eight out of ten commercial lenders approach their markets. Their marketing efforts lack an intelligent strategy and focus, and their sales efforts lack discernment, discipline and preparation.

Are there repercussions from such an unfocused, “red-ocean” approach to sales that rely too heavily on the efforts of “COIs” that with the best of intentions provide a lot of low to poor quality referrals? Absolutely including but not limited to:

- Over 50% of today’s commercial lenders don’t hit their annual sales goals.

- Lender marketing efforts are very “hit or miss” wasting time that could be put to better use

- Being buried in renewals of small, unprofitable relationships all of whom want service

- Lenders who sound and sell alike which creates market commoditization, price sensitivity and margin pressure

The honest truth is that the sales activities of the majority of your lenders are incredibly inefficient and marginally ineffective. Your lenders are simply working way too hard for what they produce.

We’ve spent the past sixteen years showing commercial lenders of all experience levels how to be much more productive.

Click Here To Learn How To Help Your Lenders Become Much More Productive

Here’s to your marketing and sales success!

Leave a Reply

Want to join the discussion?Feel free to contribute!